ESMA consults on EMIR clearing of FX NDF

(Last updated: )

On October 1 2014, the European Securities and Markets Authority (ESMA) issued its third in a series of consultation papers on the clearing obligation under EMIR (ESMA/2014/1185). Following Consultation paper no. 1 on interest rate swaps (IRS) and paper no. 2 on credit default swaps (CDS), the latest publication clarifies the regulatory technical standards (RTS) on foreign-exchange non-deliverable forwards (FX NDF) under Article 5(2) of EMIR. Feedback from interested stakeholders is required by 6 November 2014.

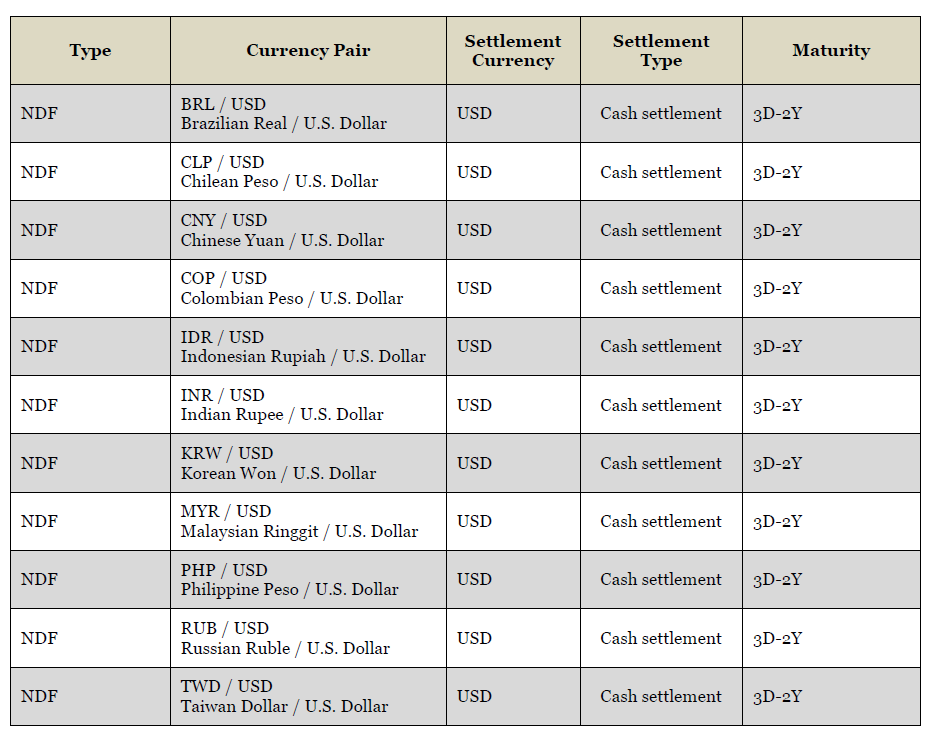

The proposed structure includes the characteristics listed in the ESMA table below.

Table 1: NDF classes authorised to be cleared

- Currency Pair – Indicates the notional and settlement currency with 11 currencies in total.

- Settlement Currency – USD.

- Settlement Type – Cash.

- Maturity – Indicates the range of maturities or tenors of the contracts covered ranging from 3 days to 2 years.

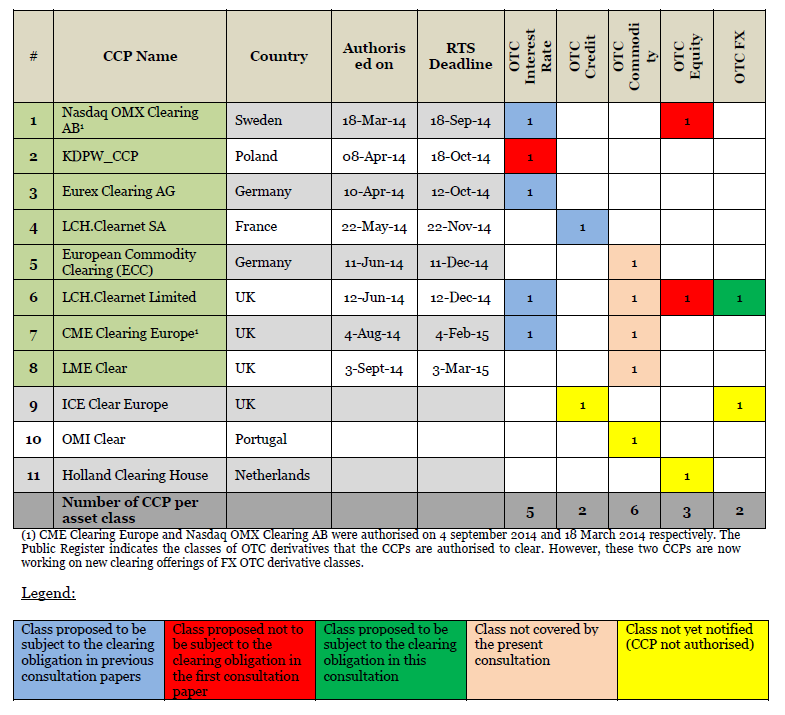

It is worth noting that LCH.Clearnet Limited is currently the only authorised CCP to clear this class. ICE Clear Europe is yet to be authorised. An updated version of the ESMA summary table is reproduced below.

Table 2: Asset-Classes cleared by European CCPs