Bailey’s freshest tips for the Brexit Break-Up

(Last updated: )

Earlier this week, the Chief Executive of the FCA, Andrew Bailey provided us with a recent update about the current state of affairs regarding Brexit. As is fast becoming the norm in Bailey’s Brexit updates, he opened his speech with the progress that has been made thus far; the Temporary Transitional Power regime; the signing of Memoranda of Understanding with EU markets and the passing of over 50 statutory instruments to on-shore EU legislation by the deadline.

Having lulled us into a feeling of mild contentment, Bailey then went on to list the seven major areas that require further action from the UK or the EU. They are as follows:

- Share Trade Obligation (STO)

- Derivatives Trading Obligation (DTO)

- Clearing

- Uncleared Derivatives

- Data Exchange

- Progress on contract repapering

- Retail financial services

Issue 1: Share Trade Obligation (STO)

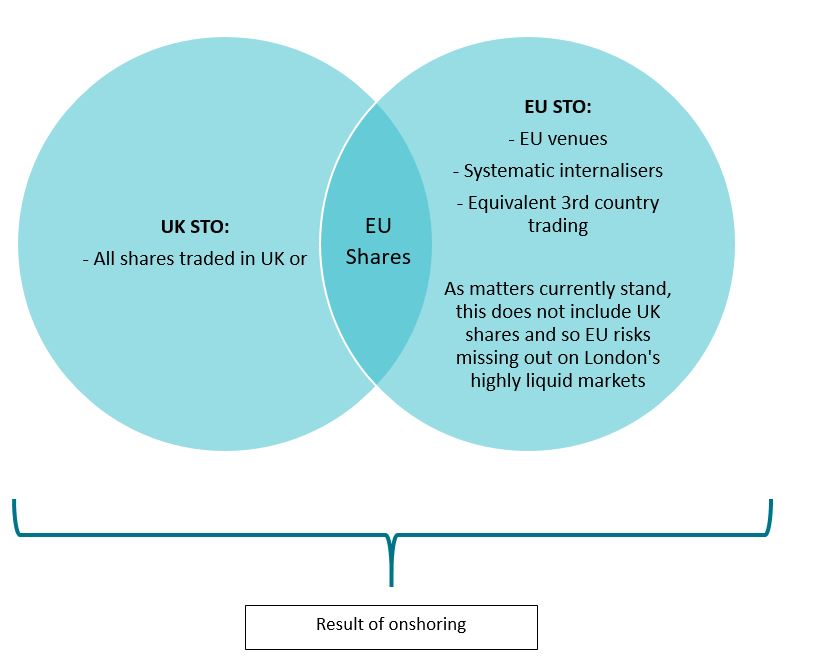

The STO is a ruling under MiFIR (Markets in Financial Instruments Regulation) and Article 23 of MiFID II requires EU firms to trade specific shares only on EU venues, systematic internalises and in a third country that is deemed to be equivalent to the EU. As it stands, the UK is still a part of the EU and so qualifies as an EU approved trading venue. But since the prospect of a no-deal Brexit has morphed into a very real possibility, Bailey is urging firms to stay vigilant.

When the requirement was first imposed, there were 6,243 shares that were bound by this obligation, including 14 highly liquid shares with a GB ISIN (International Securities Identification Number). All of these shares would have to be traded on EU traded platform. This drew sharp criticisms from the FCA, who pointed out that post Brexit, this could mean that EU-based investors might be denied access to some stocks that were actively traded in London. In May, ESMA revised the STO by removing the GB ISIN shares from the scope of the ruling. This was a positive step in the eyes of the FCA, since it reduced the number of entities that EU buy-sides would have to trade on domestic platforms. Nonetheless, this been insufficient assuaging the FCA’s concerns that the STO could still cause disruption to investors.

A significant number of the remaining, in-scope companies (EU-27 ISINs) are primarily traded in UK markets, despite having being incorporated in the EU. The FCA has felt from the beginning that ISINs should not determine the scope of the STO. By constraining the EU-27 ISINs to Europe, investors are losing out on the freedom to choose their trading venue, especially where it means they might lose out on a more liquid venue.

To mitigate the risk, the UK has on-shored the legislation, so UK STO now covers UK shares and EU shares. But the EU is still unwilling to grant equivalence to the UK, and therefore unwilling to adopt UK markets as a part of their authorised trading venues. This has resulted in an STO overlap, and as per Bailey’s suggestion, the problem can be best represented by a Venn diagram.

Bailey claims that this overlap means that ‘market liquidity would be damaged to no good end’. According to him, a declaration of equivalence would be the best way to bring back this liquidity, and failing that, a creative use of transitional powers could be adopted to mitigate the disruption from the overlap.

2) Derivatives Trading Obligation (DTO)

The nature of the DTO is similar to that of the STO described above; the EU’s DTO requires EU firms to trade certain classes of OTC derivatives on EU or equivalent third country Trading Venues. Currently, OTC derivatives that are affected by the EU’s DTO have their liquidity pool in the UK, and without equivalence, EU firms may lose access to these pools.

Bailey’s steps to prepare for no-deal are similar to those for STO: to work with EU regulators to avoid duplication of EU and UK DTOs.

3) Clearing

Given the undeniable importance of clearing regulation, both the UK and EU authorities have taken credible steps to account for the risks that could arise after the October deadline. There is a temporary recognition in place for UK CCPs which is due to continue till March 2020. The UK government has also passed legislation that will permit UK businesses to use EU-based clearing houses for 3 years from the date of Brexit.

Bailey once again emphasises that these measures are not permanent. EU regulation could be changed in a short time-frame, and it is entirely possible that the EU will extend the temporary recognition past March 2020 to facilitate and easier transition process. His opinion is that the best outcome would be for the EU to grant permanent recognition to UK CCPs.

4) Uncleared derivatives

The Temporary Permissions Regime and Financial Services Contracts Regime will permit firms to service existing uncleared derivatives between UK and EU counterparties, but the EU has not returned the favour. This has prompted member states to seek out individual licenses with UK parties to prevent disruption to contract continuity, but there is no doubt that a EU centralised approach would do a lot more to steady the uncertain waters.

5) Data exchange

As is becoming a pattern with these issues, the UK government has legislated to have free flow of personal data from the UK to the EU in a no-deal scenario, but the EU is yet to take any reciprocal action. Bailey highlights that since the introduction of MiFID II in January 2018, the FCA has passed 70% of transaction reports to EU counterparts. The lack of mutuality in this aspect is a potentially troubling thought, especially since an undisturbed flow of data is essential to tackling cross-border market abuse.

6) Progress on contract repapering

Repapering contracts continues to be one of the slower-progressing aspects of the post-Brexit preparation. Several EU Member States have legislated to allow UK firms to continue temporarily in their domestic domains in the event of a no-deal, but each of these regimes vary in their duration and their scope of permitted activities. The FCA will be instrumental in updating and co-ordinating the interaction between different member states and UK firms. The FCA has been efficient in updating market participants about upcoming regulatory deadlines, but the roughest part of the road is still to come. Bailey’s advice to firms that have outstanding contracts with counterparties or customers in the EU is for them to ensure they have done what they need to avail themselves of these regimes, and speak to the relevant Member State regulator if necessary.

7) Retail financial services

The majority of UK firms have confirmed that they plan to maintain existing products and services to their customers resident in the EU. Firms have generally used their initiative to stay informed about relevant transitional regimes offered by member states and their legal position in the market. There is less for the FCA to do in this area, and they have said that they expect firms to act accordingly based on their local and regulatory requirements.

Bailey’s comments predictably emphasised the equivalence ideal, but in the meantime he is urging firms to communicate with their counterparties and set up alternate arrangements where possible. In an uncharacteristically inconclusive speech, perhaps the biggest takeaway from Bailey’s words is the sense that progress on a post-Brexit is limited as long as the EU is unable to reciprocate the UK’s desire for mutual recognition in this increasingly complicated break up.

Contact Us