The ISDA 2016 Variation Margin Protocol – A Step Too Far?

(Last updated: )

Introduction

On 16 August 2016, ISDA published the “2016 Variation Margin Protocol” (the “VM Protocol”), designed to assist counterparties in amending CSA documentation so as to comply with Working Group on Margin Requirements (WGMR) rules as implemented locally by:

- The US “Prudential Regulators”;

- The CFTC;

- The Financial Services Agency of Japan; and

- The Canadian Office of the Superintendent of Financial Institutions.

Placeholders also exist to assist counterparties which are subject to EMIR and Swiss law, once finalised rules for those jurisdictions have been published.

Operation of the VM Protocol

Methods

Three basic “Methods” exist under the VM Protocol for amending contractual relationships so as to achieve WGMR compliance:

- “Amend”: Existing CSAs are amended in accordance with WGMR requirements as implemented in the relevant jurisdiction;

- “Replicate-and-Amend”: Existing CSAs are replicated. The replica CSA sits under the original ISDA Master Agreement together with the ‘original’ CSA but is amended in accordance with WGMR requirements as implemented in the relevant jurisdiction. The ‘original’ CSA applies to legacy transactions only and remains unaltered;

- “New CSA”: A new WGMR compliant ‘bookstore’ CSA is created. In some circumstances, the parties are also deemed to have entered into a 2002 ISDA Master Agreement, with commercial terms detailed in Paragraph 6 of the VM Protocol.

Questionnaires

The “Method” to be used is determined by elections made within a standard questionnaire, which adherents to the VM Protocol complete and then exchange. Counterparties are free to select one, two or all “Methods”, a decision waterfall determining which “Method” will apply in the event that multiple elections are made.

The questionnaires also capture the commercial agreement between counterparties, such as Independent Amounts, Base Currency elections, Minimum Transfer Amounts and governing law. This commercial agreement is used to ‘fill in the blanks’ in six “exhibits”, which supplement the questionnaires and set out the new contractual terms agreed by the parties depending on (a) whether they wish to amend existing CSAs or create wholly new CSAs, and (b) their choice of governing law (New York, English or Japanese).

Silver Bullet or Iron Sulfide?

The VM Protocol is undoubtedly an incredibly impressive piece of legal drafting. More to the point, it works. Whilst complex, this is the inevitable result of it being a solution to a problem which is itself highly complex. Nonetheless, without seeking to belittle the efforts of those behind the VM Protocol, it is useful to ask whether it is really the most efficient method for achieving WGMR compliance.

The classic mass-production, large-batch processing principles which sit at the heart of all ISDA protocols can work well if the objective is to effect simple amendments on a large scale. Unfortunately, WGMR is not that. Intuitively, we think that this kind of approach is more efficient. Unfortunately, it isn’t. Certainly, it can optimise some parts of a process. However, it tends to work to the detriment of overall performance. To consider the issue in context, those looking to achieve WGMR compliance are faced with two basic approaches:

- the ‘traditional’ bilateral amendment approach; or

- the VM Protocol approach.

The former is a largely known commodity. Certainly, the sheer volume of documentation involved in achieving WGMR compliance renders a bilateral amendment project a daunting prospect. However, is the alternative really any more efficient? This question can be answered by taking a look at the basic steps in the process.

Set priorities and acquire the necessary data

Whether adopting the VM Protocol route or the bilateral amendment approach, all firms will need to understand:

- the order in which they wish to tackle their portfolio of counterparties;

- the contractual provisions currently in place with each counterparty;

- the extent to which these provisions are WGMR compliant; and

- the way those provisions will need to be amended.

Talk to your counterparty

Any well-planned document outreach programme will factor in a degree of pro-active client education so as to ‘prepare the ground’ for the subsequent amendment. In practice, the degree of education required to help clients come to terms with the VM Protocol – both in terms of the background to the WGMR amendments and the mechanism through which change is being effected – is likely to exceed that required under a bilateral route given the likely familiarity with the underlying method of directly documenting amendments.

Agree changes with your counterparty

The process for agreeing a bilateral change is both familiar and straightforward. Initial drafts are generated and subsequently amended as part of the cycle of negotiation. In the context of WGMR, negotiation may be relatively undemanding as latitude is constrained by the underlying regulation. Moreover, in the last few years, technology has become available to streamline this process. Once agreement is reached, execution takes place. In contrast, the process for agreeing changes with a counterparty via the VM Protocol route is significantly more complex and involves at least as much effort as a bilateral amendment (and probably much more).

The first step in achieving compliance via the VM Protocol is to complete a series of questionnaires. This involves sourcing and validating 29 points of data for each counterparty. Once completed, questionnaires must then be exchanged. A complex procedure must be understood in order to determine whether matching of exchanged questionnaires has taken place (we have mapped this procedure and if you would like a copy, please just email me at michael.beaton@drsllp.com). If matching has not occurred, questionnaires should be amended and re-exchanged until matching is achieved – adding further iterations to the negotiation process and adding to the overall amount of effort involved. The situation is complicated further by the fact that an adhering party acting in the capacity as an agent can restrict the application of a questionnaire to:

- only some of the principals in relation to which it acts (by completing the “PCA Principal Answer Sheet”); and

- a defined set of recipients (by identifying those recipients in the “Recipient PCA Principal Annex”).

As such, it is necessary to check questionnaires carefully to ensure that gaps in coverage do not exist.

Even then, the chances of having to execute a significant amount of bilateral amendments seems high. The figures below would suggest that the number of counterparties adhering to ISDA protocols, as a proportion of the overall number of market participants, would seem to be very small – certainly well below 50%.

| Protocol | Number of Adherents as at 19 Aug 2016 |

| ISDA 2016 Bail-in Art 55 BRRD Protocol | 145 |

| ISDA Resolution Stay Jurisdictional Modular Protocol | 200 |

| ISDA 2015 Universal Resolution Stay Protocol | 217 |

| ISDA 2015 Section 871(m) Protocol | 96 |

| ISDA 2014 Collateral Agreement Negative Interest Protocol | 582 |

| ISDA 2013 Discontinued Rates Maturities Protocol | 100 |

| ISDA 2013 EMIR Port Rec, Dispute Res and Disclosure Protocol | 13,825 |

| ISDA 2013 Reporting Protocol | 865 |

| ISDA Derivatives/FX PB Business Conduct Allocation Protocol | 75 |

| ISDA March 2013 DF Protocol | 17,982 |

| ISDA 2013 EMIR NFC Representation Protocol | 2,117 |

| ISDA 2012 FATCA Protocol | 1,855 |

| ISDA August 2012 DF Protocol | 18,576 |

Record the final agreement in a way that can be understood and consumed elsewhere in your firm

CSA amendment for the purpose of achieving WGMR compliance is not a ‘fire and forget’ exercise. The data contained within WGMR documentation is required for many purposes – internal risk management, regulatory compliance and competitive advantage. In this context, a bilateral agreement is readily understandable. It takes the form of a single, signed document from which data can be extracted with ease. In this way a view of the risk associated with that document can be created – both individually and in the aggregate.

Forming an understanding of those same risks within a VM Protocol context is likely to be far more challenging. At a minimum, those adopting the VM Protocol route will have to read three documents together (the exchanged questionnaires and the relevant exhibit) in order to make sense of the commercial agreement. This is made more difficult by the fact that (a) the exhibits are often drafted in the alternative (for example, in relation to the Minimum Transfer Amount and Rounding) in order to capture all of the possible elections a party may make in its questionnaire, and (b) in some circumstances the amendments made to exhibits as a result of elections made in questionnaires only apply to certain exhibits and only if particular “Methods” have been selected.

If that weren’t confusing enough, things are complicated yet further by the fact that, in order to generate a comprehensive picture of their commercial agreement, adhering parties will also have to factor in the terms of:

- their underlying ISDA Master Agreement schedule: by way of example, under the “New CSA” Method, the Base Currency will be the Termination Currency under the accompanying master agreement, provided that (a) it is the same currency for both parties, (b) it is a “Major Currency”, and (c) it is a non-discretionary choice. If not, the Base Currency is the currency which matches the type of CSA (e.g. USD for Exhibit NY-NEW). That is, of course, unless the parties have both selected a single, identical, alternative Base Currency within their matched questionnaires, in which case that selection will be the Base Currency. Confused?

- other ISDA protocols: for example, if the parties have chosen the “New CSA” Method and have previously agreed to apply negative interest rate provisions (either directly in their documentation or through adherence to the ISDA 2014 Collateral Negative Interest Protocol) then the “Negative Interest” election within the New CSA created via the VM Protocol will be applicable. Confused yet?

- other elections made within a questionnaire: for example, in relation to New CSAs, any election of the parties to add additional currencies or sovereign debt securities are only effective if the “Collateral Expansion Condition” is satisfied i.e. if the answers of both parties to the question “Consent to Substitution Required?”(located elsewhere in the questionnaire) match. Yes, it confused me too.

Surely, the requirements of ongoing risk management would suggest that firms should simply agree and document amendments on a bilateral basis in a single document. Interpreting elections in the light of peripheral documents and fall-back rules seems fraught with danger, particularly when those documents are being interpreted by an individual less familiar with the detailed operation of VM Protocol, as will inevitably be the case at some point.

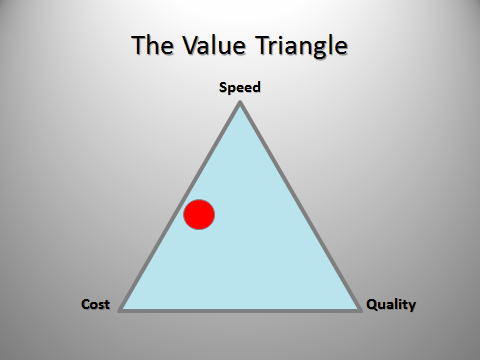

Fundamentally, in conducting a WGMR compliance project there is no escaping the classic value triangle – a simple but powerful model which explains the relationship between value, cost and time. It works on the basis of prioritisation. Typically, it is not possible to prioritise more than two of the three elements of the triangle. As such, if cost and speed is the priority – as tends to be the case when adopting a protocol-based approach – quality is inevitably compromised. In reality, the secret to long-term success is to find the right balance. In this respect, the VM Protocol falls a long way short.

The Value Triangle