A Christmas present you may have missed

(Last updated: )

Headlines

- Firms entering the scope of margin requirements for the first time have until the end of the calendar year (or six months, whichever is longer) to put into place the practicalities required for posting initial margin.

- Firms entering the scope of margin requirements for the first time due to a change in netting status of a jurisdiction have twelve months to put into place the practicalities required for posting initial margin.

- EEA UCITS remain eligible collateral until 31st March.

- Third-country funds that meet certain requirements are now eligible collateral.

The 15th December joint policy statement from the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) follows the consultation paper published in July, which received two responses. This policy statement has adjusted aspects of margin requirements for OTC derivatives contracts that are not transacted through central counterparty clearing, as well as making a couple of changes to eligible collateral possibilities.

These adjusted requirements are now effective, having taken effect on publication of the statement (i.e., 15.12.22). They apply to PRA-authorised firms that constitute financial counterparties under Article 2 of UK EMIR (the European Market Infrastructure Regulation), and to FCA-regulated entities and non-financial counterparties that fall within UK EMIR’s margin requirements.

IM transition period

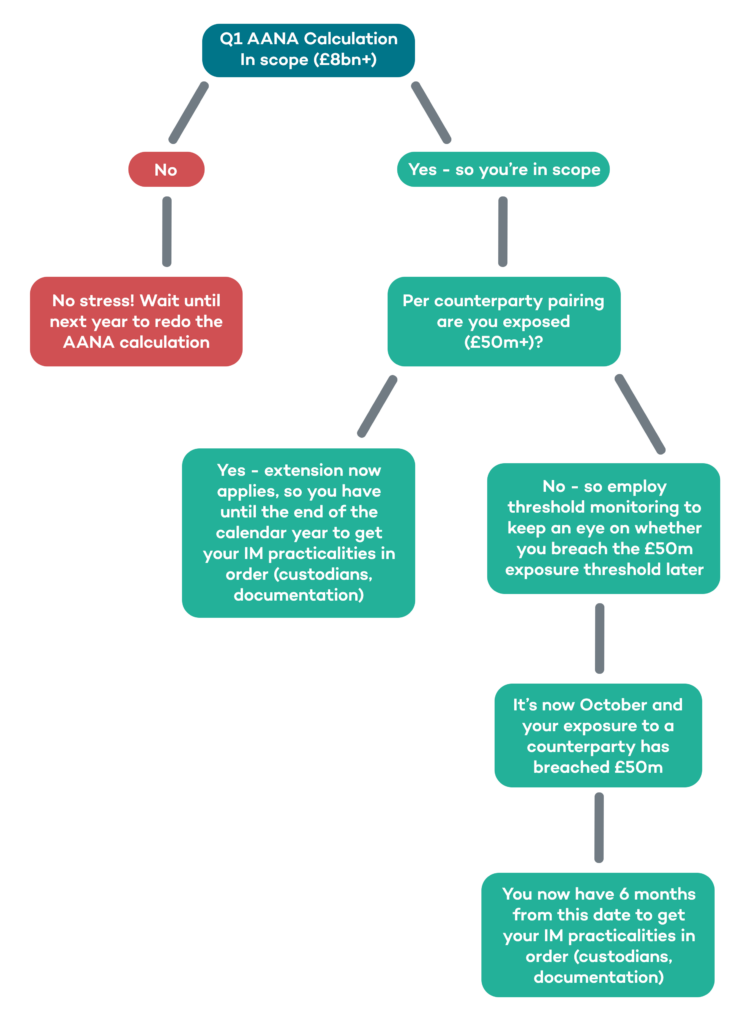

The Regulators have introduced a fall-back transitional provision of 6 months or the end of the calendar year, whichever is longest from the firm entering the scope of the requirements. This is for ‘normal’ circumstances where firms would fall within margin requirements for the first time (e.g., meeting the €8 billion threshold that came into force in ISDA’s ‘Phase 6’ in September 2022). Firms come into scope on the conclusion of their Q1 AANA calculations. Firms in formal scope will be monitoring their exposure to counterparties – it is possible that such exposure breaks £50m in the second half of the year. If this happens, they have six months to put in place the appropriate suite of IM measures, rather than the deadline being the New Year.

This move from the Regulators means that firms now have until the end of the calendar year, which will be welcome news for firms having to put IM procedures in place for the first time from a standing start, as they will no longer be theoretically subject to regulations from day one. When AANA calculations are complete and you have both £8bn+ in total and £50m+ exposure to the specific counterparty, you now have until the end of the calendar year to make those IM arrangements. If your counterparty exposure breaches £50m in the second half of the year, then you now have six months (into the New Year) to get your house in order.

These practicalities – setting up bank accounts, independent custodians, IM documentation etc. are costly and time-consuming procedures. The current Binding Technical Standard (BTS2016/2251) does not provide for a transition period – this means that firms entering the scope of the requirements could potentially be subject to immediate adherence to margin requirements.

This only applies UK-UK (as the Regulators have been able to act unilaterally without reference to their European ‘colleagues’). It is mostly relevant to those firms that have only had to start to think about IM since Phase 6, but will also be of interest to larger firms that trade with smaller counterparties.

This move from the Regulators only emphasises the need to be prepared well in advance – firms may now have some leeway in getting their IM house in order following their notional threshold-breaching AANA calculation, but the nature of IM means that instituting the myriad complexities cannot be rushed.

IM transition period – netting status changes

There is a different arrangement for firms that fall within margin requirements for the first time due to a change in jurisdictional netting status, with the fall-back transitional provision extended to 12 months. Accession of new jurisdictions to a more amenable netting status is relatively rare. However, recent Chinese legislation has led to ISDA recognising the enforceability of close-out netting in that jurisdiction. Although the Chinese derivatives market is still relatively small – capturing only around 1% of the global market – it is the last major economy that did not have recognised close-out netting.

EEA UCITS

EEA UCITS (Undertakings for the Collective Investment in Transferable Securities) will remain eligible collateral until Friday 31st of March – this deadline has been extended from 31st December 2022. The original extension was created by the PRA retaining EEA UCITS as eligible collateral after the end of the Brexit transitional period. March, however, is not particularly far away, so firms may be caught out if they have not checked their eligible collateral schedules and excluded EEA UCITS. This is most likely to apply to pension/investment funds, which typically have larger holdings of UCITS than banks or hedge funds. It would be worth checking that EEA UCITS are not an important part of your ECS by March.

Third-country funds

The Regulators will update the eligible collateral list to include funds from all third-countries that meet their requirements (e.g., only investing in otherwise eligible government securities and cash). The Regulators expect firms to have completed the risk assessment relevant to these third-country jurisdictions, and that that legal framework provides an equivalent to the risk management protections applied to UK UCITS. This expands the range of options possible for firms needing to meet margin requirements, which may well be of urgent utility on the inevitable next occasion when the liquidity of standard collateral assets suddenly dries up.

Conclusion

The policy statement seems to have flown slightly under the radar – possibly a side effect of its release at the start of the festive season. The extension to netting is to be welcomed, but in reality will be infrequently triggered. These changes demonstrate different aspects of our recent divorce from the EU. Each shows the UK’s ability to move faster than leaden-footed EU legal processes. However, this is something of a mixed blessing:

- The removal of EEA UCITS represents a Brexit disbenefit – less collateral is available to be used by UK firms.

- There is a strong likelihood that these Initial Margin changes will be replicated in other jurisdictions, but to date this may well represent a rare sighting in the wild of a unicorn – an actual Brexit benefit.