Industry split on EMIR clearing of FX NDF

(Last updated: )

On Friday, ESMA published the responses it received to the third consultation paper on the clearing obligation under EMIR (ESMA/2014/1185). The consultation paper outlines the regulatory technical standards (RTS) on foreign-exchange non-deliverable forwards (FX NDF) under Article 5(2) of EMIR.

The proposed structure excludes physically settled FX contracts with cash-settled forwards subject to mandatory clearing from 2017. This distinction is made as the two categories of products expose the central counterparties to completely different types of risk. ESMA also considers contracts cleared by LCH.Clearnet with maturities between 3 days and 2 years, settled in USD, in 11 currencies (please see earlier blog for full list of currencies).

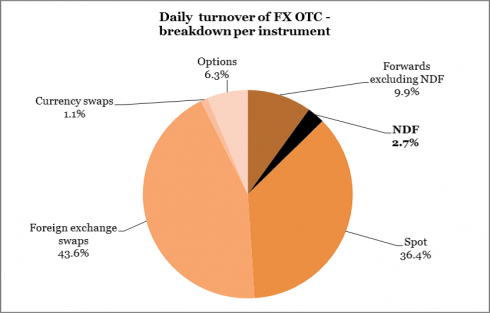

The introduction of mandatory clearing of certain classes of OTC derivatives with the objective of reducing systemic risk has been met with some opposition from market participants. Those opposed argue that the size of the NDF market is very limited. According to ESMA, it represents only 2.7% of the average daily turnover of the OTC FX market making it difficult to conclude that it will bring any systemic risk (see Figure 7).

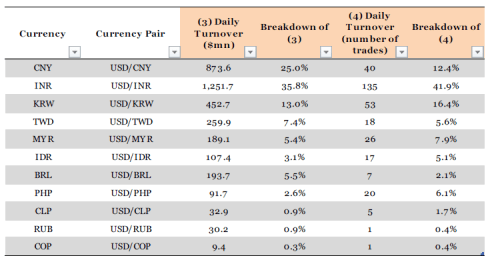

The low liquidity of the European NDF market was also raised. From the 11 studied currencies, activity is concentrated in only three currencies (China, Korea, India) comprising 75% of the total cleared turnover (see Table 6). Supporting this argument is the fact that currently only one European CCP, LCH.Clearnet, is authorised to clear NDF. However, ESMA believes an additional three CCPs (CME Clearing Europe, ICE Clearing Europe and Nasdaq OMX Clearing) have plans to clear these products.

Other respondents which included clearing houses, naturally, remained generally supportive but offered specific suggestions for improvement. One proposed amendment is to only capture maturities of up to 6 months due to the reduced liquidity of contracts beyond one year.

With no industry consensus the future seems somewhat unclear particularly if one considers the continued delays in the US – NDF clearing was first suggested by the CFTC back in early 2013. Ironically, the only topic respondents to the consultation did see eye to eye on was the need for agreement between the regulators which seems unlikely anytime soon.

Figure 7: Daily Turnover of FX OTC – breakdown per instrument

Source: BIS Triennal Central Bank Survey, data of April 2013

Table 6: Daily Turnover of NDF cleared at LCH.CLearnet Ltd

Source: LCH.Clearnet Ltd, ESMA calculations. Transaction cleared between 9 July and 28 August 2014. Not adjusted for double-counting

Contact Us