Net Exposure

(Last updated: )

“Transaction Exposure” is calculated on a transaction-by-transaction basis. However, it is quite possible (and indeed likely) that counterparties to a Global Master Repurchase Agreement will have executed multiple Repurchase Transactions between them. Moreover, under some of those transactions, one party is likely to have “Transaction Exposure” towards its counterparty whereas, under other Repurchase Transactions, the counterparty is likely to have “Transaction Exposure” towards the first party. Given this fact, it is necessary to work out “exposure” ACROSS THE ENTIRE RELATIONSHIP in order to make sure that the correct amount of collateral is being transferred or returned. Fortunately, the GMRA addresses this issue using the definition of “Net Exposure”.

At a high level, “Net Exposure” is the net amount that one party would be owed by its counterparty if ALL of the Repurchase Transactions between the pair executed pursuant to the GMRA were terminated at the same time.

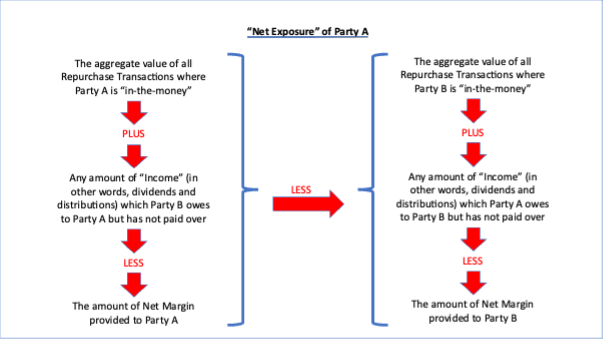

More specifically, the “Net Exposure” of a party (“Party A”) is:

In calculating “Net Exposure”, to the extent that any amount is not denominated in the Base Currency, it must be converted into the Base Currency, at the “Spot Rate”.

If a party has “Net Exposure” with respect to its counterparty and wishes to receive a “Margin Transfer” (which it normally would), it must actually serve a notice on its counterparty, requiring the “Margin Transfer”. The notice can be given orally or in writing (“in writing” includes electronic messaging systems and – at least in the case of the 2011 GMRA – also includes email). It is also worth noting that a failure to make a margin call does not constitute a waiver of the right to call for margin (see Paragraph 18 of the 2011 GMRA (“No Waivers, etc.”). As an alternative to making a traditional margin call, the parties can also extinguish “Net Exposure” by either repricing or adjusting one or more underlying transactions.

Contact Us