Net Margin

(Last updated: )

The Global Master Repurchase Agreement is a framework document which allows counterparties to enter into multiple underlying Repurchase Transactions. In relation to some of those Repurchase Transactions, a ‘first party’ may be purchasing securities from its counterparty whereas under other Repurchase Transactions, the counterparty may be purchasing securities from the ‘first party’. As such, it is possible that both parties are ‘holding collateral’ transferred by the other at the same time.

The concept of “Net Margin” is really nothing more than an attempt to:

- Look at the collateral which one party holds and place a value on it;

- Look at the collateral which the other party holds and place a value on that;

- See which has the higher value; and

- Take the lower value from the higher value, leaving only the excess.

In essence, the parties are seeking to answer the question “How much excess collateral (in other words, “Margin”) do I hold over my counterparty (if any)?”

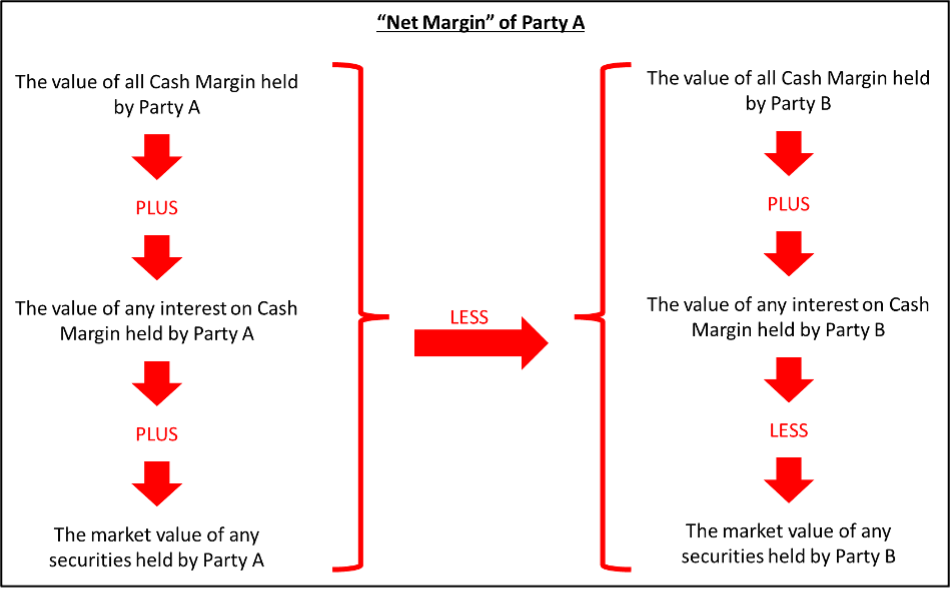

More specifically, “Net Margin” of a party is calculated as follows (but the resulting number CANNOT be negative and is floored at zero).